Property owners in Downtown South voted to approve a 1 mil tax for neighborhood improvements which amounts to a .001% tax.

The new tax district passed with 323 parcels representing $143 million of property value voting yes and 191 parcels representing about $86 million voting no.

The referendum needed more than 50% of the voting property value to pass.

Approximately $93 million worth of the yes vote was Orlando Health.

About 44% of the ballots that were mailed out were returned and counted.

These results still need to be certified by the City Clerk and go to City Council for acceptance.

The additional tax will be assessed on the property tax bills that go out this fall.

About $325,000 a year will be raised with this tax. The exact budget for how this will be spent has not been created yet.

Now that the tax has passed, the Downtown South Neighborhood Improvement District Advisory Board will begin discussing their capital improvement plan.

This plan will prioritize and identify infrastructure improvements for the district for the next five years.

That plan will need City Council approval.

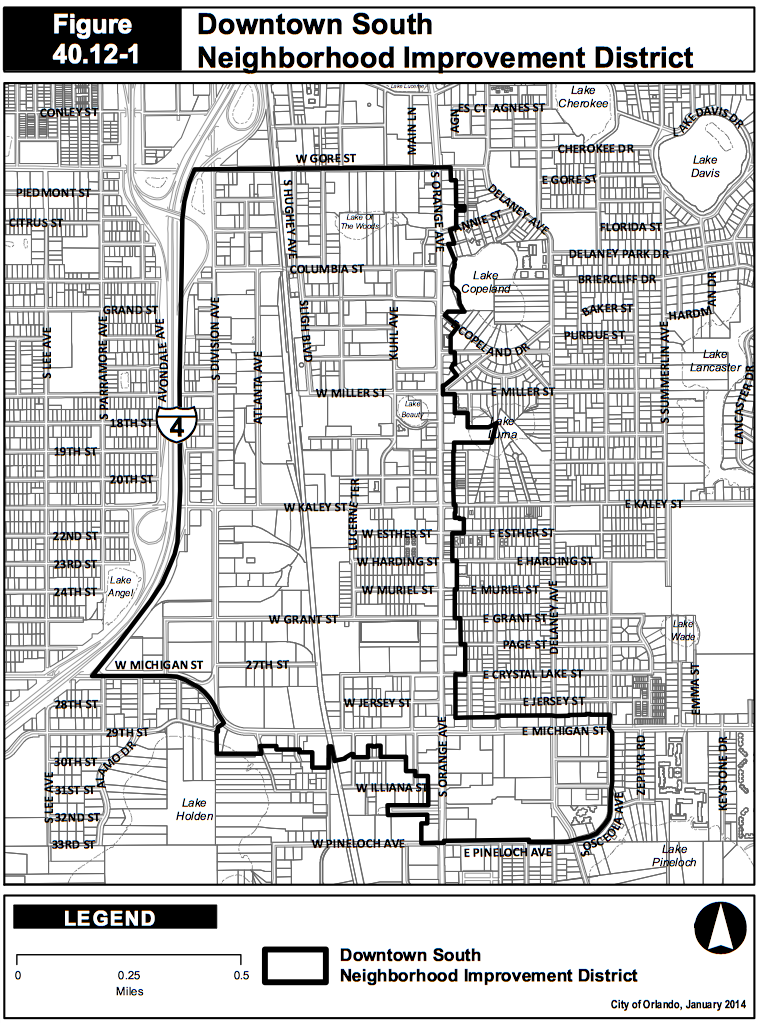

Here’s a look at the map showing the district:

http://bio.tribune.com/MarkSchlueb

“results show 49 property owners representing 323 separate parcels (over 1/2 of which are owned by ORMC) voted

in favor of the tax increase, and 137 property owners representing 191

parcels voted against it”

By a margin of almost 3-1 the individual property owners voted against this….

Why should a property owner…ORMC…be able to vote to Increase my taxes when they don’t pay ANY property taxes themselves? It’s mighty nice of them to voluntarily contribute 1 or 2 mills….I would gladly contribute 1 or 2 mills also if I didn’t have to pay any other property taxes.

Most of the improvement will happen on Orange Ave. in front of ORMC….it seem like their impact fees…if they are even paying any of these, should be paying to improve Orange Ave.

I assert that this election was a slam dunk for ORMC before it even started…they knew it…and even funded a consulting group to spin the story. Just more corporate welfare on the backs of individual tax payer.

If ORMC accounts for 40% of the property value in the area, and are voluntarily offering $1 million or the $2 million annual tax benefit, they are actually accounting for a higher percentage of the overall tax than the individual property owners.

Yeah…Great News for all those that get to benefit from this Tax without having to pay it. Not so great news for those of us that have to pay for it. What a scam, the majority of property owners voted against it, but since ORMC’s property value accounts for over 40% of the value of the properties in the area, it was a foregone conclusion that this would pass…However, all ORMC has to pay is the 1 Mill (which they agreed to pay…since they are tax exempt on property tax) while the rest of the property owners..including me, get a tax increase to fund improvements to ORMC expansion.

Now that’s what I call democracy….NOT…more like corporate welfare!

Great news. So much possibility on the area but ugly and completely unfriendly to pedestrians and cyclists.

Traffic has been a nightmare and is only getting worse — Orange Ave. needs to get people out of their cars or we will just avoid the area altogether … even crossing on foot is scandalous

If the government could be trusted with our money to spend wisely and efficiently I would be all for it as a commercial property owner….”if”

All Main Streets should do this.

This was approved by property owners; it was voluntary to enhance the area and do more projects. Good strategy that’s enabled by state law.

They are taxing us too much already. They need to waste less money and learn to be financially responsible with what they have. The problem is, they know they can keep asking for more, and they over pay contractors for most jobs.